When your small business or LLC turns a profit an admirable impulse is to invest those funds directly into stocks. While I applaud your gusto, let’s talk about why this is usually a bad idea and what to do instead.

While it is possible for an LLC to invest directly in stocks, it’s a suboptimal strategy for most businesses. Small exceptions to this are holding companies, which are created to hold and protect financial assets, or attempting to hedge financial risks.

This is a guide for operating companies: LLCs selling goods and services. We are going to explore the pros and cons of investing with your LLC vs using retirement accounts (IRA). Soon you’ll learn why investing in an IRA is a better option for most of us.

Sole Props, Partnerships, & Other Non-LLCs

Since there’s no LLC legal protection for your stocks, I’m not considering this a viable option in this guide. Please do your research and speak with an accountant and/or attorney if you are considering investing using your business bank account.

LLC Direct Stock Investing Pros & Cons

It’s possible to invest your LLCs income into stocks by creating a trading account through an online brokerage. That said the reasons for doing this are pretty thin when compared to investing with an IRA.

Pros:

- Buying stocks could be a hedge against financial risks your business is exposed to.

- Your LLC’s stocks are more protected from your personal legal liability.

Cons:

- Selling your stocks becomes an immediately taxable event.

- Your LLCs stocks will be exposed to business risks (ie customer slips and falls).

- Creating a financial hedge for risks can take a lot of financial savvy.

- Your operating agreement has to expressly allow you to buy stocks as a member.

- At best there’s no tax advantage for LLCs to invest directly in stocks.

- At worst capital gains could be treated as your earned income, which is worse tax treatment than if you just invested as an individual paying capital gains.

- Additional bookkeeping and accounting requirements and paperwork for your business.

As you can see the cons far outweigh the pros for investing directly with your LLC. Let’s look at a better strategy!

IRA Investing Pros & Cons

Here we are comparing self directed retirement accounts: Solo 401k, SEP, SIMPLE, Roth, and others. Most of these retirement accounts are available to small business owners. However let’s look at why this is a better approach than above.

Pros:

- Funds within these accounts can grow tax free.

- You get an income tax deduction for contributions.

- Excellent asset protection, which we will discuss more below.

- Can defer taxes to an advantageous time.

- Taxed as capital gains not as expensive earned income.

- Ability to invest in real estate and small business.

Cons:

- Eventually taxed when you withdraw from the account.

- Not a hedge for risks your business is facing.

- Setup, paperwork, and maintenance.

While these lists are not comprehensive, you can quickly see why retirement accounts are an amazing strategy. However if you’re not convinced let’s discuss each approach in more detail.

Why an LLC Would Directly Buy Stocks

As we discussed, there may be some uncommon reasons why you may want to purchase stocks directly through your LLC. If your business is facing some financial risk you need to limit, purchasing stocks as a hedge may provide some safety. For example farms often hedge against the risk of crop failure by purchasing securities.

Another notable exception is holding LLCs designed to manage investments. Since we are discussing operating LLCs in this article I’m going to leave researching this up to you.

In summary: for those of you who do not invest for a living, please reconsider investing directly with your LLC. There are better options available to you though retirement accounts.

Still Interested, Here’s How

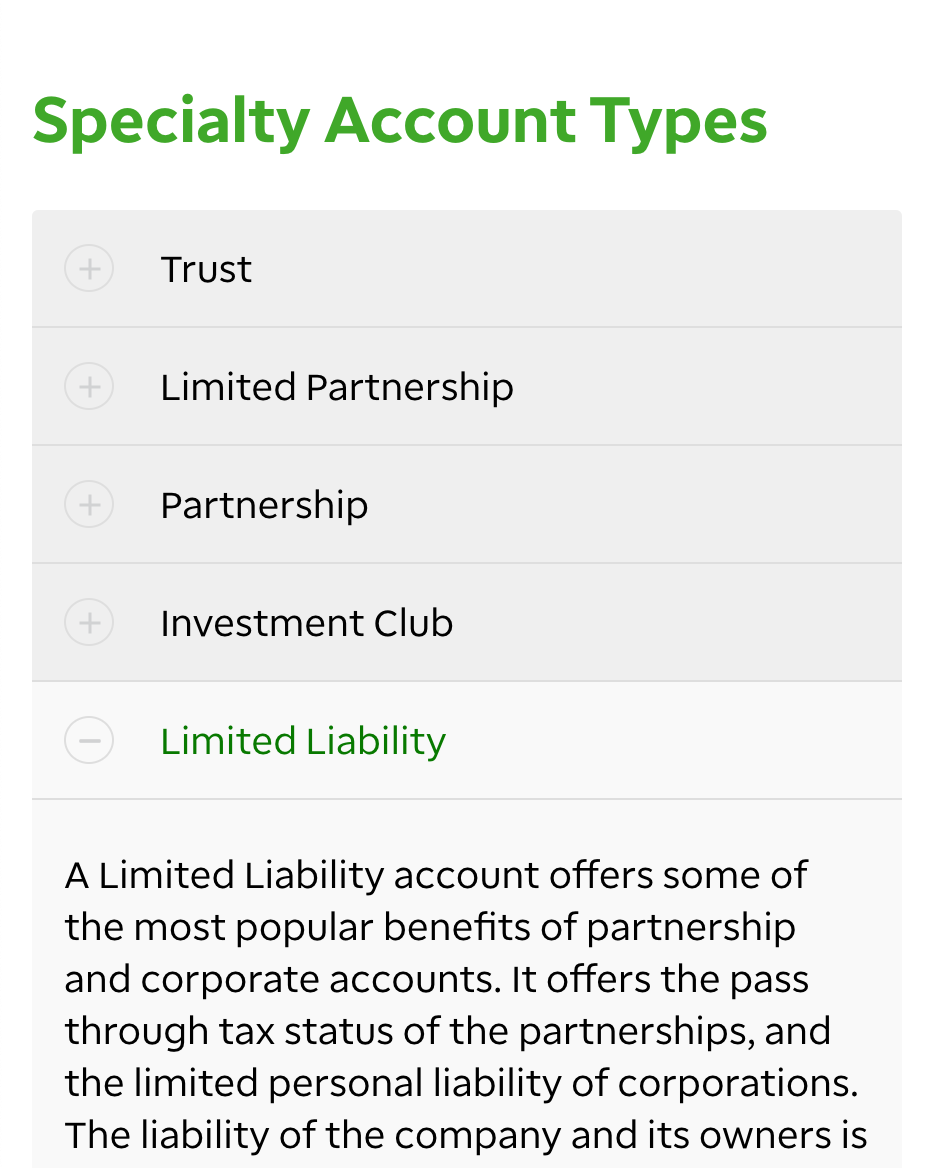

If you're undeterred from investing with your business, online brokerages make it easy for LLCs to create an account. TD Ameritrade provides some helpful instructions for many types of companies. we're not affiliated with TD Ameritrade and we're not recommending them. This is only an example of any easy way to set this up for yourself.

How IRAs and Retirement Accounts Work

Individual retirement accounts or (IRA) are tax advantaged vehicles which the self employed can use to invest in stocks and more. Examples of self-directed IRAs include: Roth, Traditional, SEP, Simple, and Solo 401.

Which IRA is Best?

Each retirement account has their place, however some will work better for you based on your goals. This is a complex topic so be sure to talk with an accountant about which retirement account is best for your situation.

Business owners can set up these accounts through their LLCs. Members and even company employees can be compensated via an IRA. So instead of drawing funds to yourself directly, you would “pay yourself” by having your business contribute to your retirement account.

Retirement Accounts: Better Tax Advantages

IRAs are fantastic vehicles for investing in ways your LLC is not. Stocks you buy and sell inside these accounts grow tax free. When you're finally ready to withdraw from your IRA the resulting taxes have been deferred to complement your tax strategy. Finally each time you contribute to one of these accounts you are eligible for an income tax deduction.

Unlike investing with an online brokerage, IRAs have more options available to them. Depending on which retirement account you set up, you can invest in gold, rental properties, and even other LLCs. This opens up a whole other world of opportunities that brokerages simply do not offer.

Retirement Accounts: Great Asset Protection

Retirement accounts generally enjoy excellent asset protection from bankruptcy, creditor seizure, and other legal concerns. If you were considering investing directly with your LLC for the legal protection, you may not be gaining any more security. Federal legislation such as ERISA & BPCP have established robust protections for retirement accounts.

Next Steps

If you’re new to investing and finally have the extra cash to do it, hopefully I’ve made the case why you should consider using a retirement account. Unless you’re trying to hedge risks your business is facing with financial engineering, you’ve learned that using an IRA is the better approach.

For many new business owners setting up an IRA seems overwhelming and that may be a sign to hold off until you are comfortable with the added complexity. That’s completely understandable. Until then focus on your business and accept that your tax bills will be higher for a while.

At least now we’ve laid the groundwork for how to handle investing your business’s extra funds in the most advantageous way. However if you’re ready to move forward with a retirement account speak with your accountant or CPA about which vehicle will work best for your situation.