About This Calculator

If you’re a freelancer, consultant, or small business owner (like yours truly), selling products or services, then this calculator shows your major tax expense: Self Employment. Self Employment consists of two taxes for Social Security and Medicare.

Understanding how these taxes work can earn you substantial financial savings as an entrepreneur. In this article you’ll learn how we calculated the above estimate, how using deductions reduces this tax, as well as next steps to improve your tax strategy.

How Was This Result Calculated?

Let’s start with some quick definitions:

Business Net Income (NI), basically your revenues minus normal business expenses. This is the basis for many other calculations made.

Above the line deductions - IRS approved items that can be subtracted from net income. The calculator took one of these for you known as the self employment deduction.

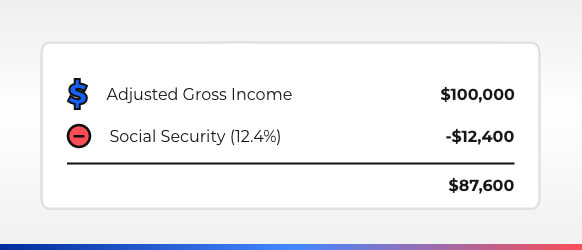

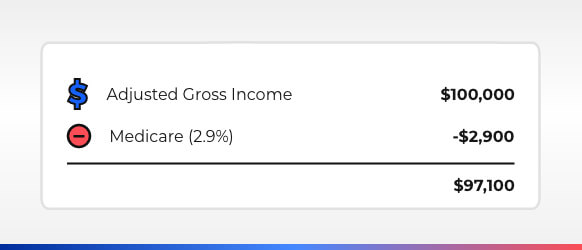

Adjusted Gross Income (AGI) is your net income minus “above the line” deductions.

Because your Social Security and Medicare tax bill is based on your Adjusted Gross Income, you want to take as many deductions as you can to reduce it.

While we’ve only taken the self employment deduction into account, there are a few others for small business owners to take advantage of.

Where’s my QBI Deduction?

A popular deduction in recent years is the qualified business income or QBI, which can reduce business owner’s taxable income up to 20%. It’s not included above because it’s considered a “below the line” deduction having no impact on self employment taxes.

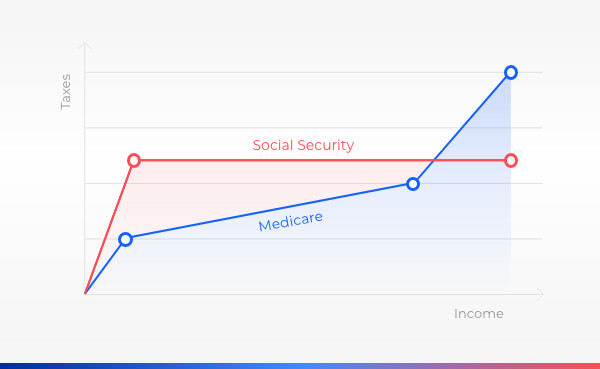

Once you’ve applied all above the line deductions to your net income and have found your AGI, next you need to calculate your Social Security and Medicare tax bills. Unfortunately calculating Social Security and Medicare can be tricky because of “caps” and added taxes.

W2 Assumption

This calculator assumes that all your Social Security taxes were withheld from your salary before calculating your final result.

Calculating Medicare

Medicare is 2.9% for the vast majority of self employed people. If however you’re a high income earner please read on to see if you’ll get hit with the added 0.9% tax. Most of you can skip to the next section.

Now for high income earners: Medicare can actually be thought of as 2 separate taxes: the 2.9% tax we already discussed and an extra 0.9% tax on all income above a threshold. This threshold is based on your filing status (ie married, single, etc).

Please note I said “all income” again because you have to include your W-2 job income. Now where W-2 income can help you reduce social security taxes on your business net income, it can hurt you with Medicare.

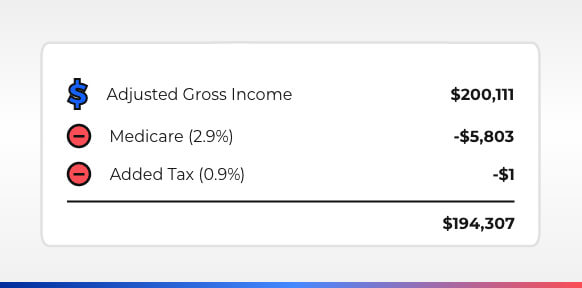

This is because Medicare tax has no cap and even increases on income over a certain level ($200,000 for single filers in 2020). Here’s a contrived example to help illustrate: a single filer has $200,111 in AGI. That person would owe $5,804.22 in all Medicare taxes. That’s $5,803 plus $1 in added tax on the $111 income above the single filer threshold of $200,000.

See how Medicare can eventually become 2 separate taxes for higher incomes?

Additional Medicare Tax Thresholds (2017 - 2020)

| Status | Threshold Amount |

|---|---|

| Single | $200,000 |

| Married (filing jointly) | $250,000 |

| Married (filing separately) | $125,000 |

| Head of household | $200,000 |

| Widow with dependent | $200,000 |

Deductions To Reduce Self Employment Taxes

Step one when looking to reduce self employment taxes is taking all above the line deductions. Below is a non-comprehensive list of the most important deductions to should consider:

Self employment deduction - the easy one already included in your estimate above.

Health Savings Account (HSA) contributions are a much larger topic, but count towards compensation in many cases reducing AGI.

Retirement account contributions. Research: IRA, SEP, Solo 401k, or Simple IRA to see which would work best for your situation.

While there’s other above the line deductions out there, their effectiveness may not have a major impact on your tax savings.

Aren’t There More Deductions?

Of course there are many more “below the line” deductions. Here’s an incomplete list of deductions you’ve possibly heard of that will NOT have any impact on your self employment taxes.

Qualified Business Income (QBI)

Standard deduction

Itemized deductions

Charitable donations

How An S Corp Can Help

At last we come to an incredible tax strategy: the S Corporation! While less flexible than regular LLC’s in some ways, the S Corp can be a great way to reduce your self employment taxes.

S Corps allow owners, involved with day to day operations, to be compensated in ways that aren’t only considered “earned income”. This means that not all your compensation will get hit with expensive self employment taxes.

Of course your next question is likely: “how much of my compensation can be saved from self employment?” and the answer can sometimes be complicated. While it’s easy to get lost in the weeds of what makes S Corps tick, it’s often better to first figure out if the rewards can outweigh the costs.

That’s why I’ve created S Corp tax savings calculators for all 50 U.S. states, which you can use for free without any sign up here. That should tell you fairly quickly if this is an opportunity to explore further.

A qualified small business Accountant will help you navigate this often complicated (and very rewarding) tax saving strategy.

Conclusion

Self employment taxes are a massive expense faced by small business owners, however we’ve explored some incredible tools to help you reduce them. These tools are exactly why influential CPA’s such as Mark Kohler urge us to consider starting a business due to available tax savings.

That said not all of the deductions and strategies discussed above are automatic. Some of the best strategies (such as S Corps) are frequently confusing to new business owners. However if your journey to improving your tax strategy is anything like mine, it’s built on many baby steps.

Check and see if an S Corp is something you should consider further. Likewise with HSA and retirement contributions: first determine if they are even worth your time. Often it makes more sense to focus on growing your business, until you're ready for a more advanced tax strategy.

Changes & Updates

Changes to the calculator that might affect your tax results are listed below:

- Support for 2021 taxes added 4/2/2021

- Removed Below Line Self Employment Deduction 5/7/2021

- Support for 2022 taxes added 9/24/2022

- Support for 2023 taxes added 1/12/2024