This is a minimalist’s guide to organizing your small business finances. For those of you wanting to commit the smallest amount of time and effort for the biggest wins organizing your business finances.

Organize your small business finances in 5 steps:

- Separate business banking.

- Set aside money for taxes.

- Track all expenses.

- Track all revenues.

- Automate bookkeeping tasks.

These steps will show you how to avoid spending days or even weeks at tax time scrambling to prepare your filings. These steps were chosen because they are easy to do and will have the greatest impact on your business. While they are ordered by impact, feel free to jump ahead.

Contents

#1 Separate Business Banking

Why: Separate business banking will dramatically reduce the time you and your tax preparers spend organizing and filing taxes. It also helps you avoid legal issues.

Imagine it's April and you're pouring over your bank statements trying to remember if your latte was purchased at a business meeting. Sadly, most entrepreneurs don't have to imagine, because it happens to them dozens of times a year. The good news is this dilemma is completely avoidable by having a separate bank account for your business!

Instead of sorting through all your bank transactions for business expenses, you get straight to categorizing them for your bookkeeper. Finding these deductions will reduce your taxes and having one account dedicated to business expenses takes far less time. If you plan on incorporating your business into an LLC, doing this makes even more sense.

Mingling business and personal funds is a huge no-no for all LLCs because it could invalidate your legal protections. Even if you're not already incorporated, as your business grows you'll likely want to become an LLC. Having a separate business account is effectively done before it becomes a serious problem.

This critical step sets you up for the rest of your business finances.

#2 Set Aside Money For Taxes

Why: Taxes are your biggest expense, failing to plan for them will cause your business to enter into crisis mode every year.

Planning for taxes effectively will help you stay focused on consistently growing throughout the year. When you owe a huge tax bill, you did not budget for, you’ll have to shift focus on earning income from less profitable sources. As a small business owner I’ve experienced this first hand.

Early on in my business I failed to set aside enough money for taxes every year. Predictably each year I would scramble to pay taxes, taking on less profitable projects to pay taxes. This also had a negative impact on my best clients, that I could no longer give the same care and attention to. Simply put: by failing to plan for taxes my business failed to grow.

At the end of this guide I’ve added a bonus section that will make tax budgeting massively easier!

#3 Proactively Track Expenses

Why: Much of “tax time” for entrepreneurs is organizing expenses in order to maximize your business deductions.

Tracking expenses as they occur will help you potentially save hours organizing them once each year. Not having a clear picture of your expenses means that you’ll need to do extra detective work to categorize them or risk losing a valuable tax deduction. Spending a little time each week can only take a few minutes and be completely free.

You can start tracking your business expense for free using Google Sheets. If you don’t have a lot of expenses yet, this can be a fast, free, and effective option. Each time you make a purchase add it to an “expense” sheet. Be sure to include a date, reference to a bank transaction, and any helpful note for your bookkeeper to know how to record the expense. You’ll give your bookkeeper this Google Sheet along with your business bank statements.

Getting in the habit of proactively tracking expenses will help you save even more time later in Step #5.

#4 Effectively Record Revenues

Why: like expenses, tracking revenues saves you time by avoiding having to dig through old bank statements. It also helps you gain critical insights about your customers.

Your bookkeeper and accountant will need to know when your revenues were paid and by whom. Knowing your revenues is not only essential for paying taxes, but also for creating the financial statements of your company. You can also use this information to see who your most valuable customers are.

Over time you'll learn which customers are slowing your business growth. Your best customers will become even more apparent, often paying every invoice on time without drama. Bad customers tend to pay later, take up extra time, and make up a smaller portion of your revenues. Great business owners are able to use this information about their revenues to see if they can better serve their best customers and even fire their worst ones.

Peaked your interest? Checkout the excellent book: The Pumpkin Plan by Mike Michalowicz (not an affiliate link).

#5 Automate Bookkeeping

Why: Businesses with a lot of expenses can save hours by automating bookkeeping with software. This can also give you real time reporting on important financial metrics.

Eventually the Google Sheets approach outlined in step #3 will stop scaling as your business expenses grow in number. You’ll simply be spending too much time managing your expenses (especially the recurring ones). Automate this work away by purchasing bookkeeping software such as Quickbooks or similar competing products you like.

By adding a banking feed to your bookkeeping software and adding rules for recurring transactions you’ll save hours over the course of the year. Work with your bookkeeper to make sure you set up these rules properly. You can even take this a step further and ask for help getting instantly generated cash flow and income statements. This will give you immediate feedback on how your business is doing financially.

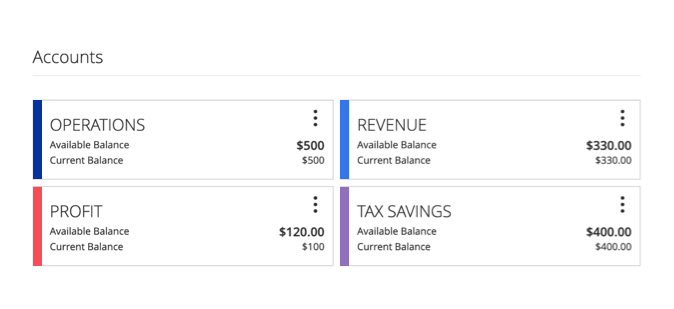

Bonus: Separate Business Banking Accounts

Why: Separating business interests into specific bank accounts make every aspect of organizing your finances easier.

Having many bank accounts for running my business has been a game changer. At minimum having a separate account for taxes makes step #2 massively easier: you’ll instantly know how much you’ve saved for taxes. It also make steps #3 and #4 easier because you’ve isolated both your incoming revenues and outgoing expenses to their own bank accounts. All this adds up to massively simplifying the tracking of your business finances.

Next Steps

If you haven’t started any of these steps simply work down the list, checking off items as you go. Whatever you do, don’t ignore steps #1 and #2 which can have serious consequences! Step #5 and the bonus step may be too much for your business right now, just plan to add them when you can.

Following these steps has saved me hours of unnecessary effort at tax time every year. One rule for you to take away: be proactive. Always ask what you can do today that will save you hours rummaging through records and tracking down things that happened over a year ago! As a bonus, deductions will come easier and your bookkeeper will not dread getting your phone calls.

Organizing my finances has given me the essential building blocks I've needed to grow my business. As my experience shows: you can't grow if you're constantly in emergency mode trying to pay last year's taxes. Organizing your finances can also help you keep and serve your best customers better.

I sincerely hope you found this guide helpful. If so please read our Ultimate Guide to Self Employment Taxes, which goes into more detail on tax savings and improving your business banking.