You may think that because Sole Proprietorships are so common in the U.S. it’s an obvious choice. But you could be making a serious mistake! The S Corporation has a lot to offer freelancers, entrepreneurs, and other solo-founders. In this article, we are going to walk through the pros and cons of each.

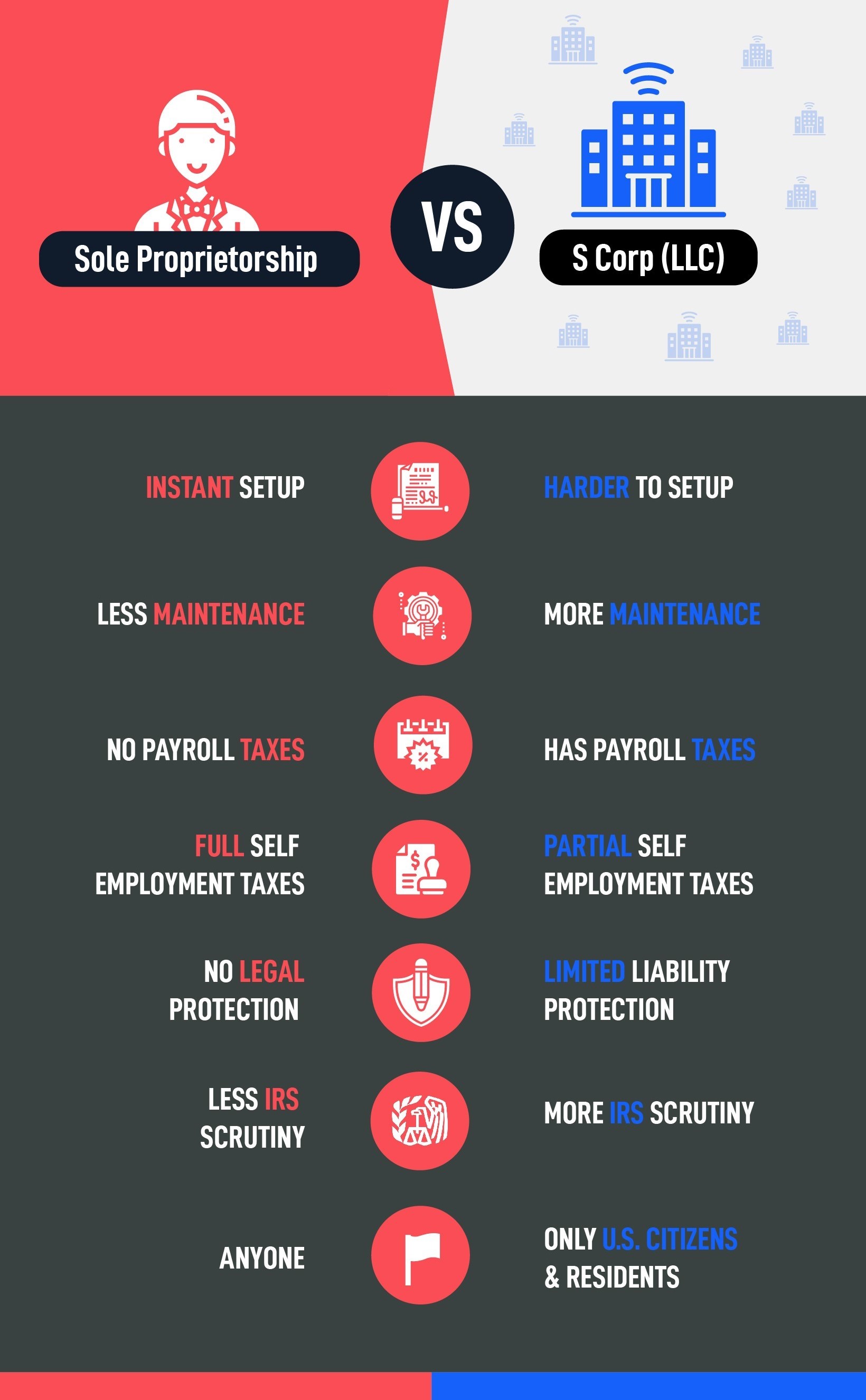

Sole Proprietorships are easier to start and used by entrepreneurs testing the validity of their ideas. An S Corporation is more difficult to start, but offer limited legal liability and partially avoid Self Employment taxes. Sole proprietorships have unlimited legal liability and are therefore not used by professional businesses.

Becoming a professional business includes choosing the right legal and tax entity, but you don’t have to make that decision right off the bat. When deciding between the S Corporation and Sole Proprietorship, their use usually depends on the stage of your business.

Which Should You Choose?

When you start a business by yourself, by opening a bank account, you’ve created a Sole Proprietorship. That’s right, you get this instantly because it’s the default for solo-founders.

A Sole Proprietorship is a default tax and legal treatment many Americans automatically get – a big reason why it’s so common. It’s estimated that 73% of all businesses in the U.S. are Sole Proprietorships. However many business owners keep it because it takes less paperwork and maintenance.

The Sole Proprietorship is the simplest business form because they’re not separate legal business entities, they refer to the person owning the business, holding you personally responsible. This simplicity is also its biggest flaw: unlimited liability. Simply put, you’re personally liable for any legal damages created as a result of your business.

That’s right Sole Proprietorships don’t offer you any legal protection. For that, you’ll need to register an LLC, or Limited Liability Company, to create a separate legal entity from you personally. This is why professional businesses are often LLC’s, including S Corps.

S Corporations are simply a tax classification that LLCs can choose to adopt. This probably sounds like jargon, so we’ll go through this step by step.

Legal entity: what’s recognized by the law. A sole proprietor is simply seen as the person owning the business, while LLCs are separate legal entities in all U.S. states. Not only do LLCs have more legal protection, but they can choose their…

Tax classification: how a business entity is treated for tax purposes. There are 3 main ones: disregarded (sole proprietor), C Corps, and S Corps. Disregarded means your LLC is ignored by the IRS and business profiles flow through to you personally.

Both the legal business entity and tax classification have defaults, which apply to Sole Proprietors. A small business with one owner gets these by default. Starting to see why being a sole proprietor is so much easier?

To become an S Corporation you need to first create an LLC, a separate business entity. Next, you opt in to being taxed as an S Corp, instead of being disregarded, to take advantage of important tax benefits (estimate those benefits here). The tax and legal benefits clearly outweigh the Sole Proprietorship, which is why it’s a better choice for a professional, more established, small business.

Setup & Maintenance

These costs are necessary for profitable businesses, but that doesn’t mean new businesses should take them on immediately. This is where the Sole Proprietorship shines. When your business doesn’t have customers, why would you put up extra costs that would only come into play once you’re profitable?

One Major Exception

If your business faces any legal liabilities, it’s worth considering becoming an LLC to protect yourself. You can still choose to become an S Corp after your LLC is established.

Sole Proprietorships are set up instantly and require less maintenance. They are not separate legal entities and don’t require any Articles of Organization. At a minimum you’ll need to file a Schedule C with your tax return at the end of the year. You may also need to make estimated payments to the IRS and your state if you’re earning a profit, to cover your self-employment taxes. These requirements are far less than the S Corp.

S Corporations are separate legal entities requiring LLC paperwork and ongoing state-level compliance. Secondly, you have to apply for an S Corp with the IRS. Once approved, an S Corp requires ongoing paperwork in order to keep their beneficial status; the most time consuming of these is running payroll quarterly. Due to all these complexities and risks, you’ll need an experienced CPA to help run your S Corp.

Legal Protection

We consider two kinds of legal liability: limited and unlimited. As you can guess, unlimited liability is something you want to avoid! However for businesses that don’t have any customers and legal risk it can make sense to wait to incorporate, becoming an LLC.

Sole Proprietorship are not separate legal business entities, so they have an unlimited liability of your personal assets. From a legal standpoint: you are the business. This means that you’re personally liable for the financial and legal obligations of your business. Any losses, debts, and lawsuits as a result of your business become personally liable to you!

S Corporation requires an LLC that protects your personal assets with limited liability. So, if you have any debts or lawsuits, personal assets such as your home are protected from creditors. Keep in mind that you might still be held liable in the case of personal negligence.

Tax Benefits

Both the Sole Proprietorship and S Corporation are pass-through entities, where profits flow through to their owners' personal tax filings. However, there are a few differences that can make the S Corporation very advantageous:

Sole Proprietorship: the business owner pays full Self Employment taxes of around 15.3%. All the profit earned from your business passes through to you on your tax return. However, since you’re not a W-2 employee, you don’t have the payroll taxes an S Corp owner does.

Self Employment

Self-employment is made up of 12.4% Social Security and 2.9% Medicare tax. A sole proprietor will pay self-employment taxes quarterly in estimated payments, declaring final amounts in their tax return. Business owners of an S Corporation pay self-employment tax as part of their payroll process.

S Corporation: owners pay Self Employment tax to a much lesser extent than a sole proprietorship business, however, they do encounter new smaller taxes such as payroll. This tradeoff works once a business has reached a modest level of profit. In addition, you’re also subject to more IRS scrutiny around what is your “reasonable salary”. If this sounds complicated, it’s because it is! Try our free S Corporation calculator to see if you should explore it more with a CPA.

Business Dissolution

We hope it doesn't come to that, but as every good business owner will tell you: it pays to have an exit strategy. If you do reach this stage, the simple rule is "easy come easy go".

Sole Proprietorship: are easier to close, and you just have to follow the standard business closing procedure: paying all debts, notifying the IRS, closing creditor accounts, and filing your remaining taxes.

S Corporation: dissolution takes a bit longer because, in addition to the standard closing procedure, you have to notify the state of the LLC dissolution and follow guidelines set down in your articles of incorporation, which must be documented. In addition, you'll need to file special paperwork with the IRS, which will take the help of a CPA.

Can Sole Proprietors Become an S Corp?

Often yes. Once you’ve established your LLC and found that the S Corporation taxes work in your favor, there are a few more requirements you should meet:

- You must be a U.S. citizen or resident

- LLC must be registered in the U.S.

- Have no more than 100 shareholders

- Have only one class of stock (means no common, preferred, etc.)

- Owners cannot be partnerships or corporations.

There are a few more requirements you can find on the IRS website. The general theme is that these entities have much more restrictive ownership requirements. If ownership flexibility is important to you, needing lots of startup capital, for example, a partnership or C Corp could be better choices.

How Does a Sole Proprietor Become an S Corp?

After you've checked that your business meets all eligibility criteria, the first step to becoming an S Corp is to register your business as an LLC in your state.

Once you've established your LLC you’ll be able to change its tax classification to an S Corp. You do this with Form 2553. This form handles your federal changes however you may need to inform various agencies in your state. This process varies from state to state, but it’s important to do this so you can file your state’s “payroll” taxes for your S Corp (these are fully considered by our calculator).

In addition, your S Corp might need to pay your state's franchise taxes (our calculator takes these into account as well). As you’d expect: more taxes mean more paperwork. So only work with CPA’s that have experience running an S Corp in your state.

Can an S Corp Have a Single Owner?

Yes, an S Corporation can have a single owner. You do not need to find a business partner or co-owner to start an S Corp. In fact, many successful freelancers and independent contractors do just this!

This is possible by creating what's called a Single-Member LLC and then changing its' tax classification. We walked through the general steps in the "How Does a Sole Proprietor Become an S Corp" section above.

If you'd like to add more members to your LLC, becoming a Multi-Member LLC, you can do that by following your operating agreement. You'll have to carefully follow a procedure to protect your business entity, as well as keep your liability protection.

Can You be a Sole Proprietor and an LLC?

The simple answer is no, a sole proprietor is not a separate legal business entity. However, if you were to become an LLC for better liability protection, you'd find that your tax returns would remain fairly similar. This is because your business income passes through to your personal tax profile.

Because of these similarities tax professionals may casually refer to a single-member LLC as a "sole proprietor", however, it's not technically accurate. An LLC creates a separate business entity, while a sole proprietor cannot claim that liability protection. An LLC that has a "disregarded" tax classification will pay self-employment tax on their business income in a very similar way as a Sole Proprietor.

A new small business owner can be frequently perplexed by how haphazardly these terms are thrown around. To avoid confusion just remember the difference between legal entity vs tax classification.

Famous Companies That Are S Corporations

S Corporations usually only gain awareness in the media when scrutinizing how much the "rich and famous" pay in taxes. A recent example of this is presidential candidate Joe Biden. According to some sources, he and his wife, have saved over $10 million in taxes thanks to using an S Corporation for his companies: CelticCapri and Giacoppa.

That said you won't find that many famous S Corporations. They simply aren't as high profile as many large publicly traded C Corporations are. The reason being it's more likely a small business would adopt this strategy.

It's still amusing to see this tax strategy gain attention on a reoccurring basis. Another famous example is actress Cynthia Nixon's company The Fickle Mermaid. Her small business would have likely escaped any noticed had it not been for her unsuccessful 2018 campaign to become New York governor.

The media generally only covers S Corporations when they are connected to famous persons. However, there are lower profile examples as well. One of the largest engineering firms in the U.S. is an S Corporation! Bechtel Corp is a great example of how far a privately owned business can scale this tax strategy.

Another noteworthy example is the Tribune Media Company (now merged with Nexstar Media Group). At the height of its success, it owned 39 television stations, including 31% of the Food Network. While today it's part of a publicly traded corporation, it had a long track record as a successful S Corporation.

Conclusion

Both Sole Proprietorships and S Corporations have their place, but only the S Corporation should be considered for a serious business.

A Sole Proprietorship is popular for easy setup and maintenance. Perfect for a new small business, not facing legal risks, while finding their footing. Unfortunately, their unlimited liability makes them a poor choice for serious small business owners.

The S Corporation, thanks to its LLC, provides limited liability and can enjoy preferential tax treatment as well. For the right business an S Corp can be game-changing, however, make sure you're willing to accept the added responsibilities as well.

If you're a visual learner this video by Independent Contractor Tax Advisors LLC is very helpful. It's a step-by-step breakdown of all the legal distinctions and tax differences we discussed here.