Every year S Corp owners selling services are asked the same question by their clients: “where can I send your 1099”? Whether you contract with an S Corp or are an owner of one yourself, this article is for you.

S Corps are not required to get a form 1099-MISC or 1099-NEC from their clients. Similarly, businesses that contract with S Corps do not need to issue them a Form 1099-MISC. Businesses taxed as S Corps report their employee earnings directly to the IRS and so do not require this form.

However, you are required to report payments to sole proprietors and partnerships. The 1099-MISC is used to report these non-employee payments made throughout the year to independent contractors. This is how the IRS knows how much tax to expect from the self-employed.

If you work with self-employed, U.S. based, freelancers it is your responsibility to issue this form. This is true as long as you paid them more than $600 within a year. The payer of the services is the one that fills out the 1099-MISC form. We'll walk you through everything about the 1099-MISC including to whom it is submitted, when it's due, and any penalties you're liable for in case of failure to submit your returns on time.

Do You Have to Send 1099-MISC to an S Corporation?

No, corporations (S Corps and C Corps) are exempted from requiring a 1099-MISC, therefore, you do not normally have to send this form to any corporations including an S Corporation. IRS uses form 1099–MISC and 1099-NEC to track payments made to self-employed independent contractors. The IRS, through this, can figure out how much taxes will be paid by those self-employed individuals or partnerships.

Contractors doing business as a Limited Liability Company (LLC) should have a Form W-9 to show whether their LLC is taxed as a Sole Proprietorship, C Corp, S Corp, or Partnership. If you see it's taxed as an S Corp or C Corp, it does not need to receive a 1099-MISC or 1099-NEC.

For LLCs taxed as either sole proprietors or partnerships, you'll need to receive a 1099-MISC from your clients. This is only required if you performed over $600 worth of work for your client throughout the year. For those hiring these LLC's be sure to request a W-9 first thing to avoid detective work the following year!

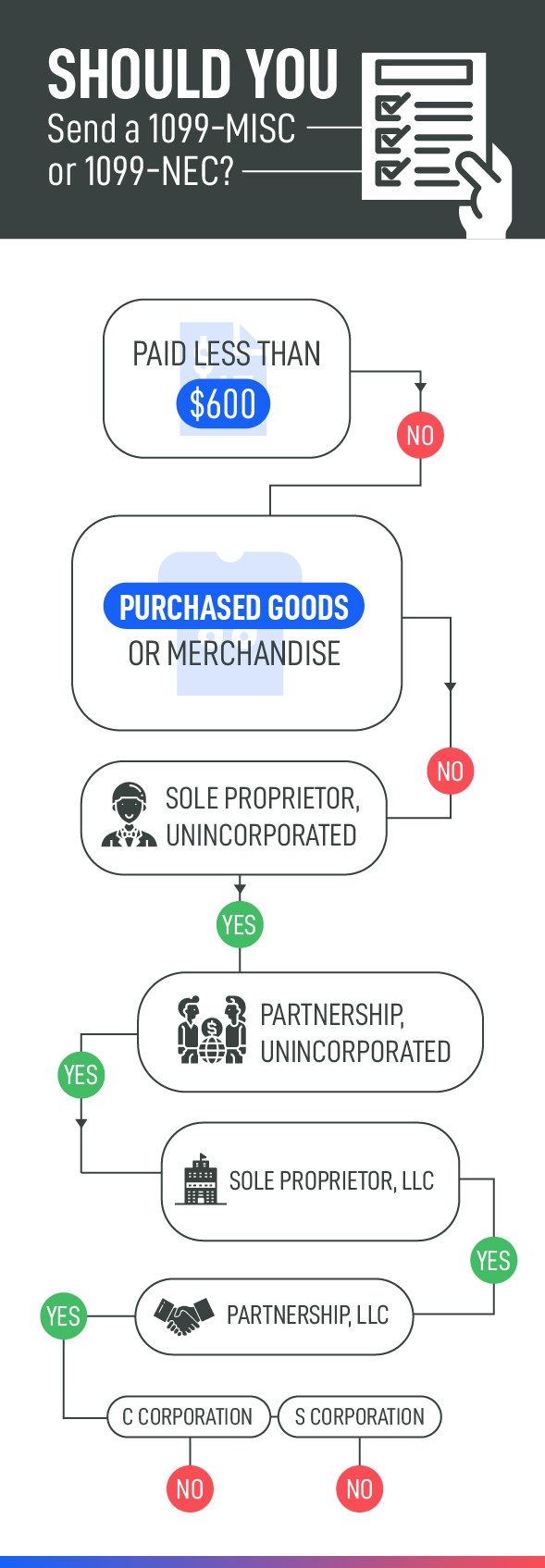

To summarize when to issue a 1099-MISC:

- Paid less than $600 - no

- Purchased goods or merchandise - no

- Sole proprietor, unincorporated - yes

- Partnership, unincorporated - yes

- Sole proprietor, LLC - yes

- Partnership, LLC - yes

- C Corporations - no

- S Corporations - no

There are some exceptions to the above when you must send a 1099-MISC:

- Attorney’s fees (or any proceeds) over $600.

- Medical and health care providers that are for profit.

- Substitute payments instead of dividends.

- Other exceptions may apply as well.

When to File a 1099-MISC & 1099-NEC

Businesses are required to file 1099-MISC and 1099-NEC before January 31st of the following year. This applies to both the 1099-MISC you send to contractors as well as the copy you file with the IRS. 1099's are a 2 step process: create one for the recipient and one for the IRS.

For example, you'd need to send your independent contractor a 1099-MISC for services paid in 2020 by January 31st, 2021. Then you'd file a copy of that form with the IRS also before January 31st, 2021. To avoid issues be sure to verify accuracy of the 1099 with your independent contractor before filing it with the IRS!

Beginning the tax year 2020, you should report non-employee compensation using form 1099-NEC!

Before filling out a 1099-MISC or NEC be sure the following conditions are met:

- You made payments to a non-employee

- You made payments for services rendered in the course of your business or trade

- Payments were made to an individual, corporation, estate, or partnership

- You paid a minimum of $600 to the payee during the year.

Minimum Amount to File 1099-MISC or 1099-NEC

The threshold for sending a 1099-MISC or 1099-NEC occurs when payments of $600 or more have been made to a freelancer or service business throughout the year. This sum is reported by the payer of the services. For instance, if you paid a freelancer only $300 for a logo, you would not need to issue a 1099-MISC or a 1099-NEC. However, that freelancer would still be responsible for reporting the amount as self-employment income.

Penalties For a Late 1099-MISC

IRS stipulates the deadline to send form 1099-MISC is January 31st of the following tax year. Businesses that file their returns by mail must send their forms to the IRS by February 28. If filing electronically, then by March 31st. Payers are required to file electronically if they are sending more than 250 1099's. They are also required to adhere to the deadlines or face severe penalties by the IRS.

The penalties range from $50 to $550 per form based on when they were submitted:

| Cost | Delay | Maximum Penalty |

|---|---|---|

| $50 per form | Within 30 days of due date | $194,000 |

| $110 per form | More than 30 days after the due date | $556,500 |

| $270 per form | After August 1st | $1,113,000 |

| $550 per form | Intentional disregard | - |

There are also penalties if you misclassify your employees as independent contractors. Therefore, it is important to differentiate employees from contractors before submitting a 1099-MISC. Small businesses could even face a maximum penalty of $1,113,000! IRS categorizes you as a small business if you earned an average of $5million or less in yearly revenue the previous three years.

How to Fill Out 1099-MISC and 1099-NEC

Form 1099 includes both copy A and copy B. You must report what you pay your contractors in Copy A then submit it to the IRS. The same information should be reported on form B and sent to the independent contractor. The contractor will use that information to report their self-employment income on their tax return.

Before completing and submitting Form 1099-MISC, you'll need to have the following information:

- The total amount you paid during the year to the contractor

- The legal name of the contractor(s)

- Their address

- Taxpayer's identification number (TIN), otherwise their social security number. Unless they are resident aliens or non-residents.

Item one should be diligently recorded by you throughout the year. For 2-4, experienced business owners can tell you it's a lot easier to simply request a W-9. It's even easier to require a W-9 before any work can be performed. This way you will not have to track down a freelancer afterword, because you already have the information you need! This important information must be entirely accurate before you file anything with the IRS. So verify amounts with your bookkeeping records and follow up with freelancers to see if their 1099 is accurate.

Sending 1099-MISC and 1099-NEC

As mentioned before you need to send two 1099's as a result of hiring a third party contractor. Firstly you'll need to send the 1099-MISC or 1099-NEC to the contractor, which in my experience can usually be done through email. Once your contractor has verified for accuracy, you'll then file a copy with the IRS and this can be done in 2 separate ways:

- Mailing copy to IRS using these instructions.

- Electronically through the IRS FIRE system.

Conclusion

Remember that both the 1099-MISC and 1099-NEC are almost always issued for services performed by non-employees. Of those self-employed companies, only those earning at least $600, need to get any 1099 form. If you are paying contractors you should issue this form before January 31st, of the following the tax year to avoid penalties. Keep in mind that S Corps are excluded from requiring any 1099 form as they report employee earnings directly.

Therefore if you work with other U.S. contractors know that you are responsible for keeping track of how much you paid them and how to fill out their 1099. Remember it’s always a good idea to ask for a W-9 from the third party before any work begins!

It’s also worth considering hiring a professional tax advisor or CPA to do this for you. They help determine whether you are obligated to report on payments you made to your contractors. They also help prepare the forms accurately and file them with the IRS. This is an especially good idea if you still have any lingering doubts about issuing your 1099's.